Business

Samsung managed to reverse its decline and retain top position in MEA smartphone market

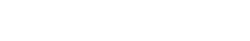

According to the latest report from Counterpoint’s Market Monitor Service, the smartphone shipments in the MEA (Middle East and Africa) region increased 1% YY and 7.5% QoQ in Q3 2021, respectively.

Among the major OEMs in the MEA smartphone market, all except Samsung and Xiaomi recorded year-on-year growth. As most of the product availability issues have been resolved, Samsung has bounced back from the lows in Q2. We hope that Samsung will further strengthen its grip at the top of the MEA smartphone table during the busy Q4 shopping season.

Transition brands like TECNO, itel and Infinix are the big winners from this epidemic. Overall, the company increased its market share from 19% in Q3 2020 to 30.5% in Q3 2021 due to strong sales in Africa and successful ventures in other regions.

Oppo and Vivo have also made significant gains over the past year as both brands continue to double their efforts to improve channel entrance and device availability. Xiaomi, which has seen tremendous growth over the past year, fell sharply in Q3 due to severe component shortages and inventory management issues.

It declined for three reasons – first, the performance of premium brands such as Apple and Samsung, whose iPhone 12 and 13 series and Galaxy Z Fold 3 and Flip 3 series were particularly popular in developed GCC (Gulf Cooperation Council) countries; Second, the introduction of new Chinese brands.

And third, Transsion, which dominates the low-cost segment in sub-Saharan Africa, has had initial success due to its branding and portfolio upgrades, providing more sophisticated devices to entry-level customers.

Get notified –

Aside from SammyFans’ official Twitter and Facebook page, you can also join our Telegram channel and subscribe to our YouTube channel to get notified of every latest development in Samsung and One UI ecosystem. Also, you can follow us on Google News for regular updates.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

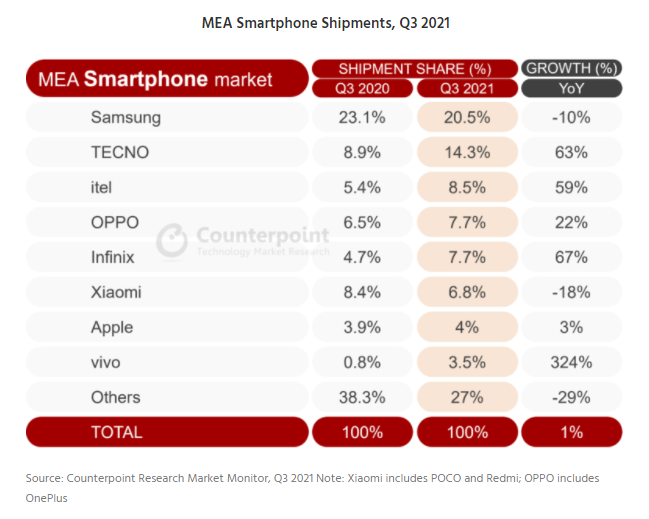

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

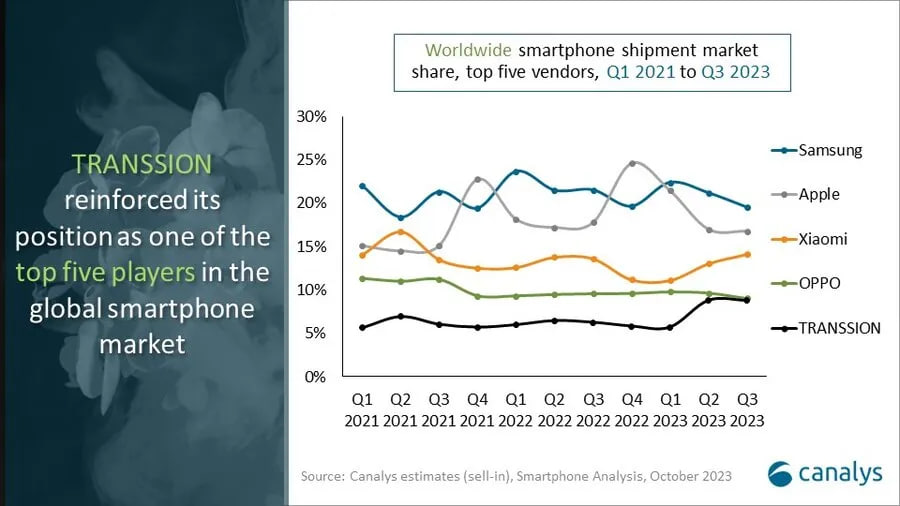

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.