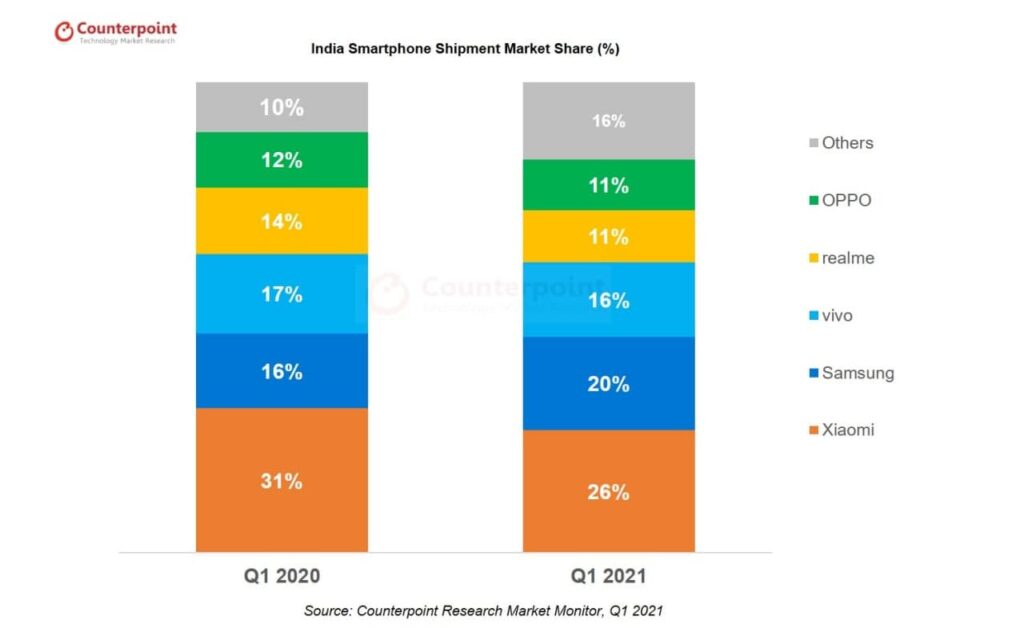

Xiaomi tops, Samsung remains on 2nd with 52% YoY growth in the Indian smartphone market in Q1 2021

Samsung maintained its second spot in the Indian market in terms of smartphone shipments. The company secured a remarkable 52% year-on-year growth, many thanks to the budget Galaxy M02 series and various entry-level phones, reports IDC.

Aside from this, the South Korean tech giant launched its new Galaxy A series smartphones including the Galaxy A32, Galaxy A52, Galaxy A72 as well as the Galaxy M12 from the M lineup, which gained a significant response from Indian consumers.

Furthermore, Samsung introduced its latest flagship Galaxy S21 series earlier than the routine launch period. Last year, the company had aggressively promoted its products through online platforms. Meanwhile, it has changed its strategy this year and attempted to gain share offline.

Samsung has offered its online exclusive F series through offline channels and is now launching new products through both channels. Inspired by the Galaxy S21 series and other flagship products, Samsung’s online portal has fared well and increased its contribution to Samsung’s channels.

Top 5 smartphone brands in the Indian market in Q1 2021

- Xiaomi – 4% YoY growth

- Samsung – 52% YoY growth

- vivo – 16% YoY

- realme – declined 4% YoY

- OPPO – grew 12% YoY

This brand grew 558% YoY!

Apart from the top 5 brands, former Xiaomi sub-brand POCO was the fastest-growing smartphone maker in the Indian market in the first quarter of this year. POCO registered a record 558% YoY growth because of the strong demand for POCO M3 and POCO X3 Pro.

Market Summary:

- Xiaomi

Inspired by the Redmi 9 series, Xiaomi retained the top spot in the Indian smartphone market in the first quarter of 2021 with an annual growth of 4%. Surprisingly, the Mi 10i 5G performed strongly in the mid-range segment.

- Samsung

Samsung is still the second-largest brand of smartphone shipments in India, with a 52% year-on-year growth, thanks to a focus on the budget segment and the launch of the newly launched M02 series and many other products.

- vivo

In the first quarter of 2021, Vivo grew by 16% year-over-year and maintained its third position. With the improvement in the status of COVID-19 and the resumption of offline channels in the first quarter of 2021, Vivo continues to be the leading smartphone player in the offline sector.

- realme

Realme fell 4% year-on-year in the first quarter of 2021, but managed to maintain its fourth position in the market. Besides, the Narzo 30 Pro was the cheapest 5G smartphone in the country during the same quarter.

- OPPO

OPPO grew 12% year-over-year in the first quarter of 2021 and has an 11% market share. The company will debut 5G in the first quarter of 2021, and its OPPO Reno 5 Pro 5G has a 3% market share in 5G smartphone shipments to India.

STAY CONNECTED WITH US:

- Join SammyFans on Telegram

- Like SammyFans.com on Facebook

- Follow SammyFans on Twitter

- Get the latest insights through Google News

- Send us tips at – [email protected]

News

Here’s why Google Messages replaced Samsung Messages on Galaxy devices

Samsung’s latest foldable phones come with Google Messages by default. The company has now revealed the reason behind this move on Galaxy devices. Samsung says Google Messages replaced Messages to foster RCS adoption.

According to AndroidAuthority, a source explained Samsung’s decision to switch to Google Messages as the default messaging app. The recently released Galaxy Z Flip 6 and Z Fold 6 come with Google Messages with RCS enabled by default.

Looks like promoting Google Messages on Galaxy devices will boost RCS adoption. Samsung Messages isn’t already installed on newer phones. However, one’s stopping you from getting it on your Galaxy from the Galaxy Store.

While many apps support the RCS feature, Google Messages offer the best user experience. Making it a default messaging app is an effort to boost the adoption of RCS tech. Apple is also preparing to bring RCS chat functionality to iMessage for iPhones.

What Samsung source said:

- Even if messaging apps follow the RCS standard, the availability may be limited depending on which app the other party uses. That’s why we decided to make Google Messages the common messaging platform, allowing Galaxy users to communicate more freely. This also enables a messaging app to respond to changes of the RCS standard more quickly and efficiently.

Previously, Samsung devices launched in the US came with two messaging apps. This time, the company has removed the Samsung Messages. During the first setup, users are notified that Google Messages is the default messaging application.

News

Samsung SmartThings gets ISO 27001 certified

Samsung SmartThings gained the international standard ISO/IEC 27001:2022 certification. The company has officially announced this major development in its global connected living platform.

SmartThings received ISO/IEC 27001:2022 certification for information security management systems. Certification reiterates that the SmartThings Cloud operates per international standards.

To be certified, a company has to meet the standard across a total of 123 detailed items, including policies for information security, access control for information assets, and incident response.

SmartThings receiving the ISO 27001 certification is the result of our sustained focus on the protection of information in a hyper-connected world with exponentially increasing intelligence.

Seungbum Choi, Executive Vice President and Head of Device Platform Center at Samsung Electronics said “this is just another step in our drive to fortify the platform’s security. We will continue to find new ways to ensure that SmartThings’ personalized services are provided even more safely.”

BSI Prez says that they have recognized that the operation capability and security level of Samsung SmartThings is excellent. It will further boost trust in the SmartThings platform and strengthen business competitiveness.

ISO 27001 is the leading global standard for ISMSs and was established by the International Organization for Standardization. It provides companies with guidance to manage the risks to information assets systematically and achieve information protection goals.

News

Dr.diary fuels Samsung Health with glycated hemoglobin algorithm

Samsung Health app integrated the Dr.diary (Doctor Diary) glycated hemoglobin feature. The blood sugar management platform announced the launch of its glycated hemoglobin estimation functionality on Samsung’s Health application.

According to ETNews, Dr.diary announced the integration of a glycated hemoglobin level feature in Samsung Health. Galaxy users will now be able to check the estimated glycated hemoglobin level provided by Doctor Diary.

To activate the feature, Health app users will have to permit certain conditions of data in the Blood Sugar service. It is worth noting that glycated hemoglobin is a key figure for diabetes diagnosis, which users will find worth using in the Health app.

Established in 2017, Dr.diary is a blood sugar management platform. It analyzes and predicts the changes in glycated hemoglobin using its own algorithm. Earlier this year, the firm secured a patent for “glycated hemoglobin estimation based on blood sugar data table.”

Song Je-yoon, CEO of Doctor Diary, said, “With our predicted glycated hemoglobin level prediction algorithm being installed in Samsung Health, more people will be able to recognize their glycated hemoglobin level and manage their health more efficiently.”

Glycated hemoglobin (HbA1c) is a standardized numerical value of the percentage of hemoglobin, such as hemoglobin, which has been glycated by glucose. Glycated hemoglobin reflects the average blood sugar level over the past 2-3 months.

Samsung Health (with Wear OS Galaxy Watch) users can conveniently check their estimated glycated hemoglobin level within the app and use this information to manage their blood sugar levels through diet and exercise.