Business

Chinese panels harming Samsung D’s smartphone display demand

On March 28, market research agency DSCC predicted that this year’s global OLED sales would be $38.7 billion, down 7% from the previous year. Since Chinese display makers selling OLEDs at cheaper prices, demand for rigid Samsung smartphone OLEDs decreasing.

According to the report, smartphone OLED shipments by the application are similar to last year, but sales are expected to decrease by 8%. Possibly, it’s because of the decrease in rigid OLED sales and the decrease in average selling price (ASP).

Samsung Display

Smartphone OLED is expected to record 77% of shipment share and 78% of sales share in the entire OLED market this year. Smartwatch OLED is expected to account for 15% of shipments and 5% of sales. As revealed by Samsung Display, it’s expected to keep its market leadership this year as well.

Samsung D will reportedly supply OLED for all four models of the upcoming Apple iPhone 15 series, with a whopping share of 60 percent. The South Korean display maker is likely to see a three-digit YoY increase in monitor and automotive OLED shipments.

BOE Display

BOE’s OLED sales share is expected to rise from 9% last year to 13% this year. In the iPhone 15 series, BOE’s share was estimated at 18%. Compared to last year, DSCC explained that in the iPhone 15 series, the number of models that BOE supplies with OLED has increased to two, a regular type and a Plus.

LG Display

LG Display could increase its overall OLED market share from 20% last year to 21% this year. The expected market share of LG Display in the iPhone 15 series is 22%. The OEM supplies OLED only to the Pro lineup in the iPhone 15 series.

This year, LG Display’s share in the monitor OLED market is expected to be 35% based on shipments and 35% based on sales. The company’s share in the TV OLED market is estimated to be 85% based on shipments and 81% based on sales.

TV OLED

TV OLED shipments are expected to decline by 12% and sales by 15%. In addition, OLED shipments and sales required for augmented reality (AR) and virtual reality (VR), vehicles, laptops, monitors, and tablets are predicted to grow.

Business

Samsung holds onto top spot but Apple, Xiaomi getting closer

Samsung remained the king in the Q2 2024 market, but Apple and Xiaomi are getting closer. IDC market research data shows that Samsung led the worldwide smartphone market in the second quarter of the year and Chinese brands scored rapid growth.

According to IDC, Samsung sold 53.9 million devices in the second quarter. The company occupied an 18.9% market share internationally. The company has slightly improved its sales share up from 53.5 million units in the same period last year.

The data suggests that Apple ranked second in terms of global volume sales. The iPhone maker shipped 45.2 million devices in Q2, 2024. It captured a market share of 15.8%, a modest increase from 44.5 million shipments in the second quarter of last year.

Third comes Xiaomi. The Chinese brand saw massive growth in sales year over year. It had sold 42.3 million smartphones in the second quarter alone. It’s a big jump from 33.2 million units shipped in Q2 2023, becoming a potential threat to Apple and Samsung.

Apart from this, Vivo also recorded significant growth in the global market. The company’s year-over-year growth in Q2 was 21.9%, with sales listing 25.9 million units with a market share of 9.1%. The growth percentage shows that aggressive marketing and boasting competitive specs into devices is paying off.

Samsung, Apple’s game isn’t over…

Last week, Samsung launched its new foldable phones, releasing on July 24, 2024. Apple, on the other hand, is expected to launch new flagship iPhones in September. It means, Samsung will enjoy the third quarter as well. The fourth quarter might be of Apple as iPhone sales would sharply grow in the global market given the new lineup release.

Samsung is now preparing to unveil new FE products later this year, followed by the S25 series in early next year. Chinese brands are expected to debut their latest flagships in the last quarter of this year, while Google Pixel phones are also coming in August.

Business

Samsung expects massive profit boom in Q2 given AI rise

Samsung today announced provisional sales and profit results for the second quarter. Samsung formally announced the provisional/predicted sales and operating profit, suggesting a massive profit boom in Q2, 2024 given the AI memory semiconductor rise.

In Q2, 2024, Samsung sales provisionally increased by 2.89% and operating profit by 57.34% compared to the previous quarter thanks to AI boom. Besides, the sales climbed by 23.31% and operating profit by 1,452.24% compared to the same period last year.

The company expects sales of 74 trillion won and operating profit of 10.4 trillion won on a consolidated basis. While these results are not final, there won’t be much change in the final result when it comes out. Samsung had a pretty profitable period in the second quarter.

Samsung in Q2

- Consolidated Sales: Approximately 74 trillion Korean won

- Consolidated Operating Profit: Approximately 10.4 trillion Korean won

The Korean tech giant is currently facing yield issues in its second-generation 3nm process. The flagship Exynos processor is unlikely to be commercialized this year. It would lead the Mobile business to face additional burdens due to rising prices of Snapdragon chipsets.

Meanwhile, Samsung is focussing on HBM (high bandwidth memory) semiconductors. HBM is a key player in artificial intelligence servers and data centers. The booming AI market will directly benefit Samsung’s semiconductor business.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

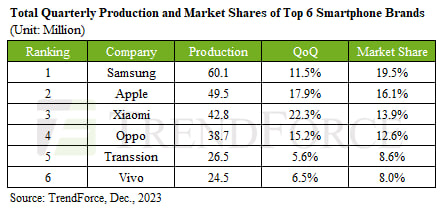

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source