Business

[Omdia] Samsung fell but ruled 2022 smartphone market, what about others?

Omdia Analysis Highlights:

- Samsung sold 259 million smartphones in 2022

- Apple was the biggest smartphone vendor in Q4, 2022

- Samsung’s market share declined by 4.8% YoY

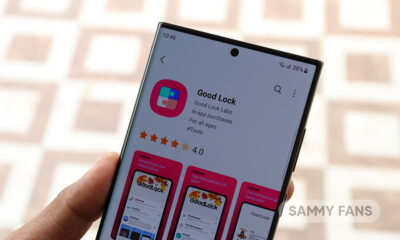

Omdia’s smartphone preliminary shipment report// In the fourth quarter of 2022, global smartphone shipments totaled 301.5 million units, which is the same as the third quarter, but decreased by 15.4% YoY. Usually, Q4 sees the most shipments but this year’s last quarter faced a drop of 0.7% than the previous quarter.

In Q4 2022, Apple sold 74 million units of iPhone models, however, shipments increased by 41.6% from the previous quarter, and fell by 13.3% year-on-year. Samsung, as per previous trends, dropped from first place to second place with shipments of 58 million units and a 15.4% drop YoY.

Follow our socials → Google News, Telegram, Twitter, Facebook

2022 was the worst year for the smartphone market with overall shipments of 1.207 billion units, a year-on-year decrease of 9.9% from 1.34 billion units last year. Samsung’s final shipments in 2022 will be 259 million units, ranking first in the world, but compared with 2021’s 272 million units, it will drop by 4.8%.

The most affected are manufacturers in China, with shipments of Xiaomi, Vivo and OPPO all dropping by double digits year-on-year. Honor is the only major player with year-on-year growth, reaching 59 million units in 2022, compared to 40 million units in 2021.

In recent quarters in 2022, most Chinese manufacturers have continued to decline. Xiaomi, Vivo, and OPPO ranked third to fifth respectively in the fourth quarter, whereas shipments fell by over 25% year-on-year. Talking about shipments, Xiaomi 33 million, Vivo 24 million, and Oppo 23 million.

Transsion ranked sixth in shipments in the last quarter, reaching 17 million units, slightly lower than the previous quarter and last year’s 18 million units. Honor’s shipments totaled 14 million units in the fourth quarter, in line with the previous quarter, but slightly down from 15 million units last year.

Realme ranked eighth with sales of 11 million units, facing a 16.9% decline from the previous quarter and a massive 31.5% decline from the previous year. It is surprising that realme has fallen more and faster than its mid-to-high-end price-focused competitors, possibly due to inventory problems in 2022.

Motorola ranked ninth with sales of 11 million units, flat with the previous quarter, but down 10.4% from the previous quarter. Huawei maintained its tenth place, with shipments of 7.5 million units, down 12.8% QoQ, but, with a sizzling jump by about 60% than the last year.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

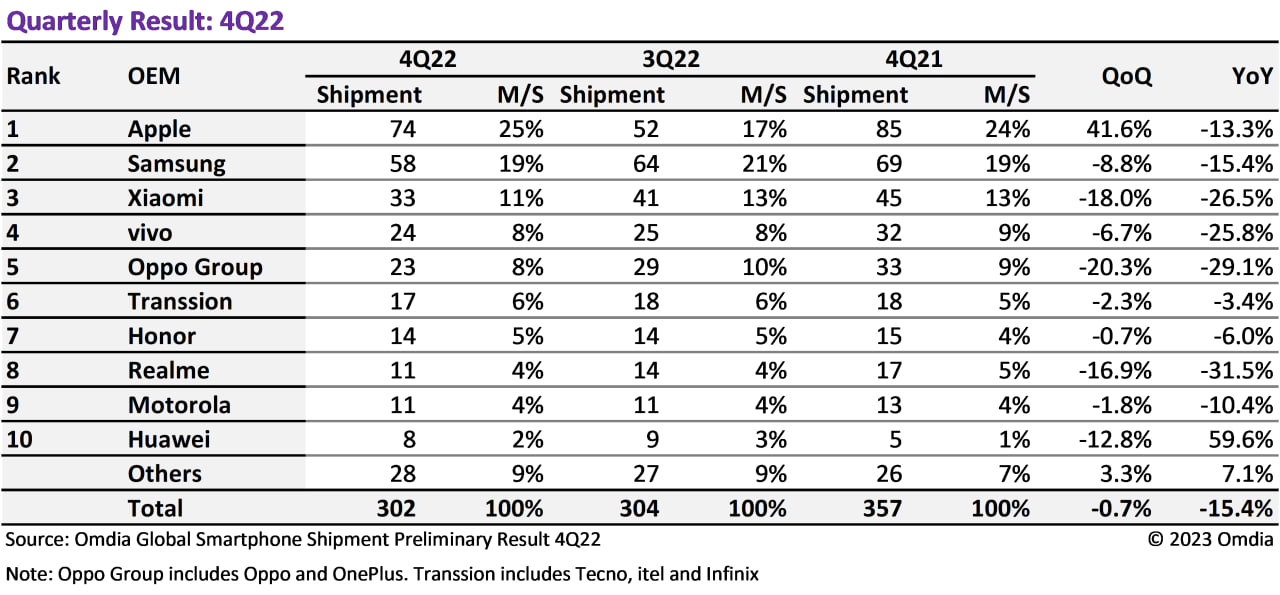

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

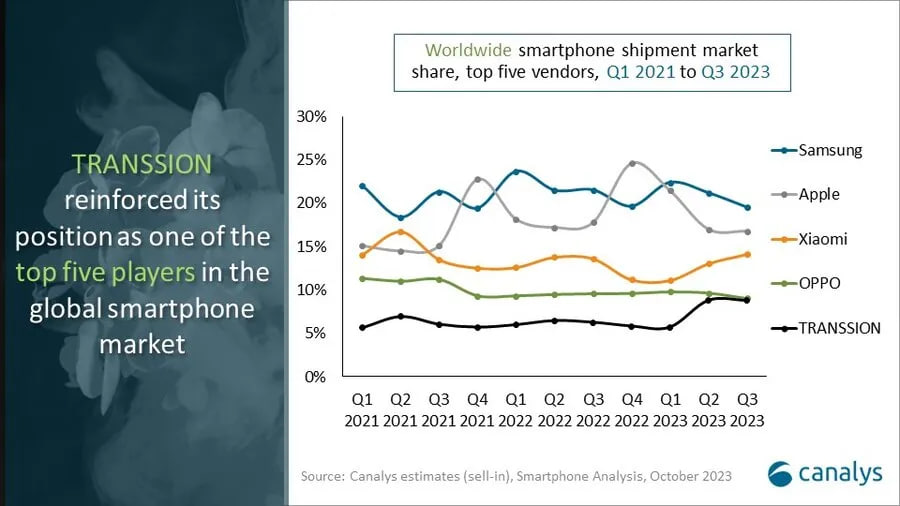

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.