Business

Samsung net profit rose 10% in Q3 2021, thanks to strong chip sales

On October 28, Samsung released its financial results for the third quarter ending September 30, 2021. The total aggregated revenue was a quarterly record of KRW 73.98 trillion, an increase of 10% over the previous year, which was the highest level previously.

And the operating profit increased by 26% from the previous quarter to KRW 15.82 trillion, the second-largest ever, as favorable market conditions continue in the memory market while established and display businesses are gaining strong sales.

The Memory Business has seen significant improvements in revenue received through quarterly record submissions, as well as DRAM’s second-highest earnings, and Foundry Business’s results have improved due to strong sales to global customers. In the Display Panel business, revenue is rising as major smartphone customers introduce new products.

The Mobile Communications Business has seen a steady increase in revenue due to the strong demand for new foldable devices and mid-range smartphones as well as growth from tablets and wearables. Networks Business has expanded its global business, including in North America and Japan, and has continued to expand its integration of 5G network into the domestic market.

The Consumer Electronics Division saw the strong expansion of the premium TV and Bespoke product list, but profits declined due to rising consumer and planning costs.

The strength of most currencies compared to Korean won, and the US dollar, in particular, had a positive impact of about KRW 800 billion on operating profit compared to the previous quarter.

In the fourth quarter, the Company will focus on meeting the memory needs and products of the semiconductor system as part-time shortages in some customers may affect demand. The company will also maintain a strong profit margin of finished products by strengthening our leadership and programs in the paid sector.

In the Display Panel business, part of the mobile panels is expected to achieve strong results with the continued demand for smartphones and the growing sales of new apps. The company is in the early stages of producing quantum-dot (QD) indicators as planned.

By 2022, amid anticipation of a sustained global IT demand, the Company’s business segment will focus on expanding advanced processes and improving product and technology leadership.

The Company’s major expenditure in the third quarter amounted to KRW 10.2 trillion, which included KRW 9.1 trillion spent on semiconductors and KRW 0.7 trillion in exhibitions. The largest expenditure to date in 2021 was KRW 33.5 trillion, which includes KRW 30 trillion semiconductors and KRW 2.1 trillion for display.

Stay tuned:

Aside from SammyFans’ official Twitter and Facebook page, you can also join our Telegram channel and subscribe to our YouTube channel to get notified of every latest development in Samsung and One UI ecosystem. Also, you can follow us on Google News for regular updates.

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

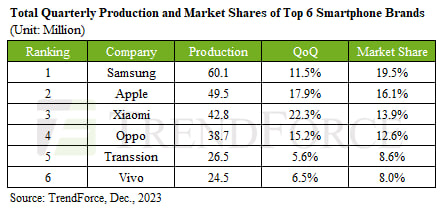

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

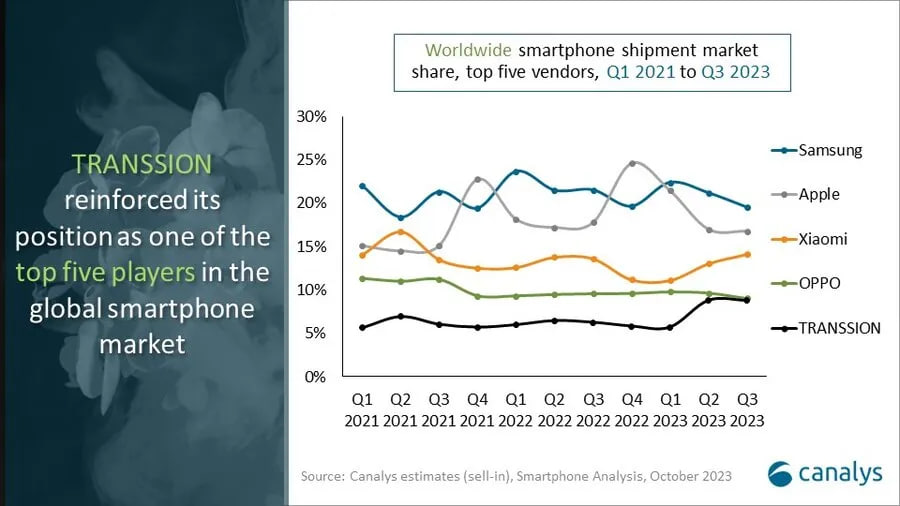

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.