Business

Samsung led the global smartphone market in Q2 2021: SA

On July 29, 2021, the market analyzing firm – Strategy Analytics released the latest report of the global smartphone exports grew +11% YoY in Q2 2021, with a volume of 314.2 million units.

This is the second annual growth rate (after Q1 2021’s + 28% YoY growth rate) in recent years, benefiting from positive comparisons. However, global smartphone exports have dropped by 11% QoQ, mainly due to the second wave of COVID-19 in India and South East Asia, as well as the impact of supply refusal.

Join Sammy Fans on Telegram

Global Smartphone Shipment in Q2, 2021

In the second quarter of 2021, Samsung retained its top spot with a market share of 18.2%. However, Samsung registered the lowest annual growth rate (+5.4% YoY) among the top five retailers. It believes that tight competition from emerging Chinese retailers and a supply chain ban have both impacted Samsung’s performance this quarter.

Xiaomi jumped to the top 2 for the first time. It shipped 52.8 million units of smartphones worldwide in Q2 2021 and took a market share of 16.8%. Of all the top five retailers, Xiaomi has registered the highest annual growth rate (+ 85.3% YoY).

Xiaomi has quickly and successfully used the chances of withdrawing LG’s withdrawal from Latin America, and Huawei’s collapse in the European region. And, Apple set a record in the second quarter. It exported 47.4 million units of iPhones worldwide and accounted for 15.1% of the market share.

The emerging markets are playing a growing role in Apple’s global map. It estimates that China has overtaken the USA the single largest market for the Apple iPhone this quarter, for the first time. 5G has enabled the iPhone 12 series to continue to be well received by loyal iPhone fans in the country.

On the other hand, the other Chinese retailer OPPO and Vivo topped the top five list, with 10.6% and 10.0% market share respectively this quarter. Both traders have seen double-digit growth rates, mainly from China, India, and other overseas markets.

//Source

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

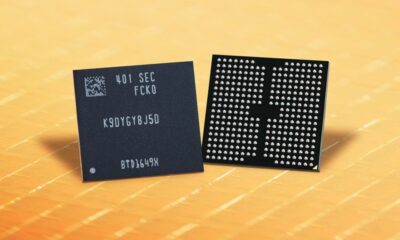

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

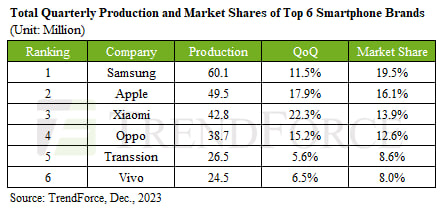

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.