Samsung Galaxy S21 series costs less than the Galaxy S20 lineup: Counterpoint

The Galaxy S21 series is the latest flagship offering from Samsung launched back in January. This is the premium range of smartphones that offer top-notch hardware as well as software including Exynos 2100/Snapdragon 888 processor, One UI 3.1 on the top of Android 11 OS, iconic camera capabilities, and much more.

However, the top-tier device of this series, Galaxy S21 Ultra costs 7% lesser than its predecessor, in terms of manufacturing. Now to prove this fact, a new analysis just surfaced on the Counterpoint research that claims, Samsung has an optimized cost structure with the devices falling between 400 to 600 US Dollars.

Moreover, the research also disclosed that Samsung’s ecosystem contributed as high as 63 percent of the total BoM (bill of materials) cost for the international edition of S21 devices. Therefore, the Korean tech giant also achieved some great sales numbers in markets such as Europe and North America.

Meanwhile, there are many reasons which lead to the cost-effectiveness of S21 phones but the one that is quite highlighting is the use of an in-house Exynos 2100 processor for some non-European markets including India.

Alongside, the integrated 5G modem in the main chipset also helps the company to follow this tradition, led to packing these handsets at a justified price with flagship goodies.

“In line with the price drops, Samsung managed to deftly balance the performance versus cost. It made a significant improvement in computing power with the 5nm process-based mobile platforms, either Snapdragon 888 or Exynos 2100 depending on the sales market, and also introduced a refreshed design for the rear camera bump” Research Analyst Parv Sharma said.

Record sales number of the Galaxy S21 smartphones

While the device cost lower to produce, S21 smartphones also saw great sales in markets such as India, the US, North America, and more. The series sales volume in February alone was 22 percent higher than the 2019 Galaxy S20 series, reaching over 3.4 million units in overall shipments.

Besides, some recent reports clearly mentioned that this episode of record-breaking sales will continue as usual. However, some new records are set to broken in the coming days when the Galaxy S22 arrives at the end of this year or maybe in January 2022.

STAY CONNECTED WITH US:

- Join SammyFans on Telegram

- Like SammyFans.com on Facebook

- Follow SammyFans on Twitter

- Get the latest insights through Google News

- Send us tips at – [email protected]

Business

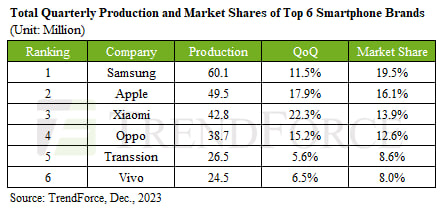

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

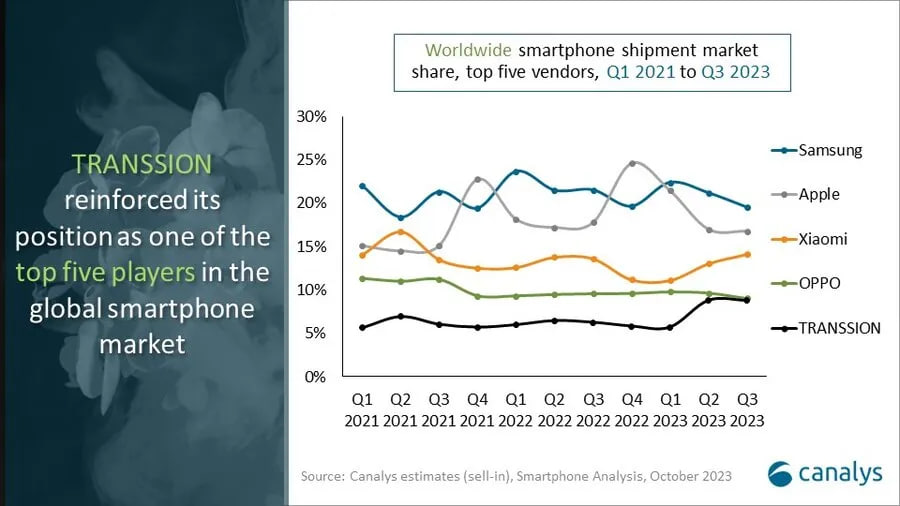

Underdog phone brand jumped 50%, Samsung and Apple lost ground

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.