Samsung plans to sell hundreds of fab equipment to UMC for P6 factory

Recently, Samsung Electronics signed an image sensor foundry agreement with UMC for the production of ISP and related panel driver ICs, countering Sony and TSMC. Moving forward, the company also plans to sell hundreds of fab equipment to UMC to support the construction of chip foundries.

According to the information, the South Korean tech giant plans to sell 400 sets of fab equipment to UMC that will be installed in UMC’s P6 factory. However, UMC’s P6 factory has not yet been put into production but the report suggests that it could start mass production in 2023 with an expected production capacity of 27,000 chips.

The same report further revealed that the UMC P6 factory will mainly use the 28nm process to produce chips for related customers including image sensors and display driver chips. However, Samsung and UMC had signed an image sensor foundry agreement, UMC’s P6 factory will also be mainly used for Samsung’s foundry-related chips.

Starting this year, UMC announced that they planned to invest US$1.5 billion in factory construction this year, and the 400 sets of equipment that Samsung plans to sell to them are not expected to be among the US$1.5 billion previously planned.

Though Samsung is an important chip foundry in the world, its holding market share is larger and technology is ahead of UMC. Their current process technology has reached 5nm, and the time for mass production is only slightly later than TSMC.

As per the reports, Samsung has handed over some of its image sensors to the foundry of UMC because the market has a strong demand for the company’s image sensors, but their own production capacity cannot meet the strong demand.

STAY CONNECTED WITH US:

- Join SammyFans on Telegram

- Like SammyFans.com on Facebook

- Follow SammyFans on Twitter

- Get the latest insights through Google News

- Send us tips at – [email protected]

| Via |

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

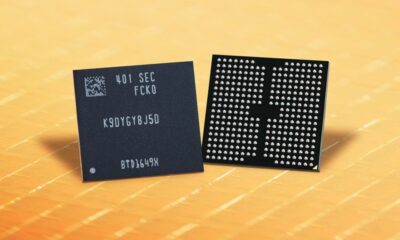

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

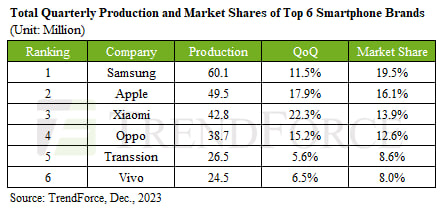

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.