Galaxy A series will help Samsung not losing top spot against Chinese rivals

Apple launched its new iPhone lineup that includes four different models including iPhone 12 Mini, iPhone 12, iPhone 12 Pro, and iPhone 12 Pro Max. The iPhone 12 is the first Apple lineup that features 5G connectivity support in all four models.

Along with its dominant reputation and privacy protection, the 5G connectivity became a big turning point to gain the sales of the latest iPhones globally. The market results also confirmed consumers’ positive response to the iPhone 12 lineup as the Cupertino tech giant led the global smartphone market in the fourth quarter of last year.

Moving forward, Samsung unveiled its new Galaxy S flagship – Galaxy S21 series earlier this year that comes at lesser pricing compared to the previous generations. The comparatively affordable price tags of these phones will surely help the company to retain the top spot in the table of the global smartphone market.

Now, according to the information, global smartphone shipments are forecast to grow 6.5 percent on-year to 1.38 billion units in 2021 and the South Korean tech giant is expected to defend its top status in the global smartphone market this year despite challenges from Chinese brands such as Xiaomi, Huawei, etc.

The reports show that Samsung Samsung’s market share is predicted at 20 percent, unchanged from a year earlier, according to market researcher Strategy Analytics. On the other hand, Apple is expected to remain second, with its market share also staying the same as that of last year at 16 percent.

Adding to this, Chinese phone makers will make strong growth this year by taking over the market share of their competitor Huawei that is struggling from the U.S. sanctions.

Furthermore, it is said that Xiaomi will rise to the third spot with a share of 13 percent, up from 11 percent a year earlier, followed by Vivo with 11 percent and Oppo with 10 percent. Both Vivo and Oppo had a 9 percent market share in 2020.

“2021 is going to be the year of Chinese smartphone vendors,” “In Asia Pacific, Vivo, Xiaomi and Oppo will become top three players driven by aggressive marketing, expanding channel footprints and competitive pricing.” said Linda Sui, a senior director at Strategy Analytics.

Strategy Analytics believes, in Africa and the Middle East, Chinese smartphone manufacturer Transsion will replace Samsung as the largest supplier in the region. In order to withstand the challenge of Chinese players with fierce competition in low-end smartphones, Samsung has high hopes for the Galaxy A series.

However, Samsung has recently launched new mid-range smartphones under its Galaxy A series that are the Galaxy A52, A52 5G, and A72. These phones feature powerful hardware, premium design, and the latest software with three year OS update guarantee that can surely raise the company’s shipments graph.

STAY CONNECTED WITH US:

- Join SammyFans on Telegram

- Like SammyFans.com on Facebook

- Follow SammyFans on Twitter

- Get the latest insights through Google News

- Send us tips at – [email protected]

Business

Samsung leads Q3 smartphone market, Huawei’s entry haunts Apple

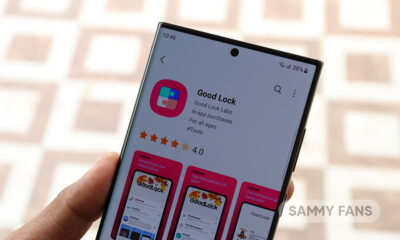

Samsung ranked first in market share in the global smartphone market in Q3, 2023. TrendForce report says that Samsung led the global Q3 smartphone market, recording a market share of 19.5%.

Overall production in the third quarter increased by 11.5% compared to the previous quarter to 60.1 million units. During the same period, Apple’s production increased by 17.9% to 49.5 million, thanks to iPhone 15.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Third place was taken by Xiaomi (13.9%), followed by Oppo (12.6%) and Transion (8.6%). 6th place is Vivo (8%). Meanwhile, global smartphone production reached 308 million units, a 13% increase compared to the previous quarter and a 6.4% increase from the previous year.

Huawei’s re-entry into the flagship smartphone market targeting Apple has had a significant impact in China. Huawei is aiming to expand its high-end flagship series, focusing on the Chinese domestic market next year, so Apple “We plan to attack directly”.

// Source

Business

Underdog phone brand jumped 50%, Samsung and Apple lost ground

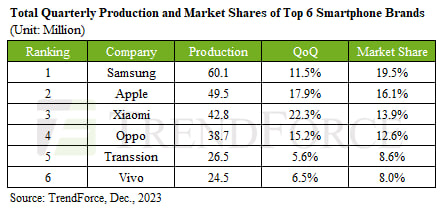

In Q3 2023, Samsung and Apple’s market share slightly declined, while an underdog Chinese phone brand appeared on the top 5 chart. In a recent development, Canalys published market research data for the third quarter, revealing Tanssion as the fifth best-seller globally.

According to the info, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. However, Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

Apart from this, Xiaomi matched last year’s share only by “recovering” from a terrible first half of 2023. At the same time, OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it’s owned for years.

Overall, the global smartphone market underwent a slight drop of 1% in Q3 2023. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

Business

Samsung enjoyed 2023’s last victory over Apple?

Recently, research agency Counterpoint Research published their latest analysis. The report reveals that Samsung continued its leadership in the third quarter of 2023, while Apple remained in the second spot. However, both OEMs faced a decline of 1 percent year over year.

According to CR, slower consumer demand is the main factor in the dwindling sales. The market did see a slight 2 percent growth in Q3 compared to Q2, likely driven by last month’s iPhone 15 series launch. Samsung secured 20 percent market share, while Apple grabbed 16 percent sales.

Follow our socials → Google News | Telegram | X/Twitter | Facebook | WhatsApp

The Galaxy A-series was the key driver for the South Korean smartphone maker. Apple came in second with 16 percent of the market while Xiaomi rounded out the top three with its 12 percent share. Oppo (10 percent) and vivo (8 percent) were the remaining brands in the top five charts.

The newly released iPhone 15 series will help Apple score a lead over Samsung in the fourth quarter of the year. The results will arrive by early next year, and it’s expected that the US phone maker could surpass Samsung. Major camera upgrades and USB-C helped Apple register strong sales.